Updated August 16, 2022

There are some new tax laws and information that I wanted to share with you.

If your corporation is an IN-ACTIVE corporation, this year you still need to file a one-time declaration with the Costa Rica Tax Authority for 2021-2022 informing the Tax Authority if it has assets and if so, the value of the investment/asset. This is for the Tax Authority to understand the present value and to avoid an increase put upon your corporation by the Tax Authority without true justification. As an example, your property is registered as an IN-ACTIVE (meaning you do not collect income from it) this filing needs to be done with an accountant indicating that the corporation has an asset and the value of that asset. THE NEW DEADLINE IS November 15th, 2022.

investment/asset. This is for the Tax Authority to understand the present value and to avoid an increase put upon your corporation by the Tax Authority without true justification. As an example, your property is registered as an IN-ACTIVE (meaning you do not collect income from it) this filing needs to be done with an accountant indicating that the corporation has an asset and the value of that asset. THE NEW DEADLINE IS November 15th, 2022.

If your CR and or foreign corporation you have is already registered as a taxpayer (meaning you are generating income or a registered ACTIVE Corporation: as an example you are renting your property) you do not need this. Best to check with your property manager and or legal team or accountant in Costa Rica that assisted you with the purchase of your property and previous tax filings, so you are up to date.

Starting this tax year, the Luxury Home Tax evaluation needs to be presented to the Tax Authority. This is done every three calendar years and is based on the materials that are used in the construction of the home. Older homes do have depreciation, so a house that once meet the Luxury Home tax thresh hold, may no longer. Again best to check with your property manager and or legal team or accountant in Costa Rica.

Just as a reminder as well, after 5 years of purchasing your property and owning it, you are required to re-registered new Declaration of the value in the local municipality for property tax purposes. This must be done every 5 years. I always recommend doing it before they do it and decide what they think your property is worth. Best to check with your property manager and or legal team that assisted you with the purchase of your property, so you are up to date.

If you own your property in the name of a Costa Rica corporation or a foreign corporation, make sure you have your corporate tax paid for holding a corporation. It blows my mind how many people forget this then after 3 years of non-payment the government shuts down the corporation. This just causes the owner of the property more grief and costs to get it re-estabilshed.

Please feel free to reach out to me if you have any questions or need any additional assistance.

Below you can find additional details and information about Costa Rican Active and Inactive Corporation Taxes.

Once upon a time in Costa Rica, it was relatively simple to form a corporation, and it was even easier to maintain it. The government imposed no annual fees, and the requirement for the corporate officers to meet once each year was no problem to fulfill.

Two factors worked together to change that. In the first place, the previous low maintenance system was prone to corruption. Unsavory types used a corporation to hide their identity and their ill-gotten gains. They could own a Costa Rican corporation anonymously and use it to launder money from the illegal drug trade or other illicit activities. Money and property could change hands without anyone knowing who the participants were. The second factor was taxes. The government realized that it was missing out on an important source of tax revenue. Tens of thousands of corporations were being used to hold assets, but the government wasn’t collecting a dime in taxes or fees from them because they didn’t have any income to report.

A new law enacted in September 2019 requires that a Costa Rican corporation disclose the identity of their shareholders or owners. That adjustment addresses the first factor. It prevents corporations from anonymously engaging in illegal activities. Other new requirements address the second factor. Now all Costa Rican corporations must pay annual fees and make yearly reports to the government about their income, assets, and ownership.

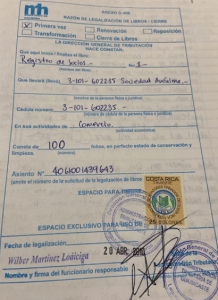

Costa Rican corporations must hold an annual shareholders meeting either in person or by proxy. The date, time, and place of the meeting as well as the names of those in attendance are recorded in the corporation’s legal registry. Any modifications that are made to the corporation’s structure are also recorded. All corporations in Costa Rica must maintain three legal record books. If the corporation does more than hold assets–that is, if it engages in economic activity–it must also maintain three accounting record books.

The corporation’s legal representative must file annually in April with the Registry of Transparency and Final Beneficiaries of the Central Bank. The filing includes details about the corporation and the name, address, identification number, and contact information of each shareholder or owner and their percentage of ownership. To file, the representative must first obtain a digital signature card from an authorized bank. Such cards are only issued to Costa Rican citizens and residents. A non-resident who owns a corporation can comply with the reporting requirements by granting a power of attorney to a third party who will then obtain the digital signature and file the disclosure.

The government charges an annual fee that must be paid to keep the corporation in good standing. The fee is approximately $120 for non-active corporations that are used only as holding companies for real estate. The annual fee for active corporations is based on income and is typically between $200 and $380. According to law 9428, the tax must be paid by January 31 each year. The company’s legal representative is responsible to declare and pay the tax. If you don’t know if the taxes are current or overdue, you can consult the National Registry database (www.rnpdigital.com).

What will happen if the tax isn’t paid? According to the Costa Rican code of taxation rules and procedures, sanctions and penalties will apply. A short term consequence of non-payment is that the National Registry will not issue, certify, or register any documents for the corporation until the taxes are paid. Neither the government nor any public institution will do business with an overdue corporation. The long-term consequences are even more severe. If the tax is not paid for three years in a row, the corporation will be dissolved. What about dissolving the corporation voluntarily? Even then, any outstanding debts must be paid first.

Clearly, the task of maintaining a corporation in Costa Rica is not as simple as it used to be. Especially if you were thinking to use one for the sole purpose of holding a property in the name of the corporation. Now it is a lot easier and more simplified to just purchase a property and put it in your personal name. The key to success is to hire a knowledgeable notary to keep you up to date and help you stay legal.

Interested in finding a property in Costa Rica? Check out our extensive listings here:

Want to keep up with everything that is happening here in Costa Rica? Join my email list!

Need more information about Costa Rica in general? Read our FAQS about Costa Rica page.

Interested in owning a property in Costa Rica, checkout some great options here

Have a comment or a question? Feel free to EMAIL ME

Like the article? Please share!